Converting Debt Into Capital

- All money is borrowed into existence. There is no way for individuals to create new money themselves. Everyone must compete for a share of the existing money supply. Everyone must rely on a chosen few who have been given an exclusive right to create, control, and own, the nation's currency and credit supply. Every dollar in existence is being rented by someone, somewhere in the economy, from the money creators.

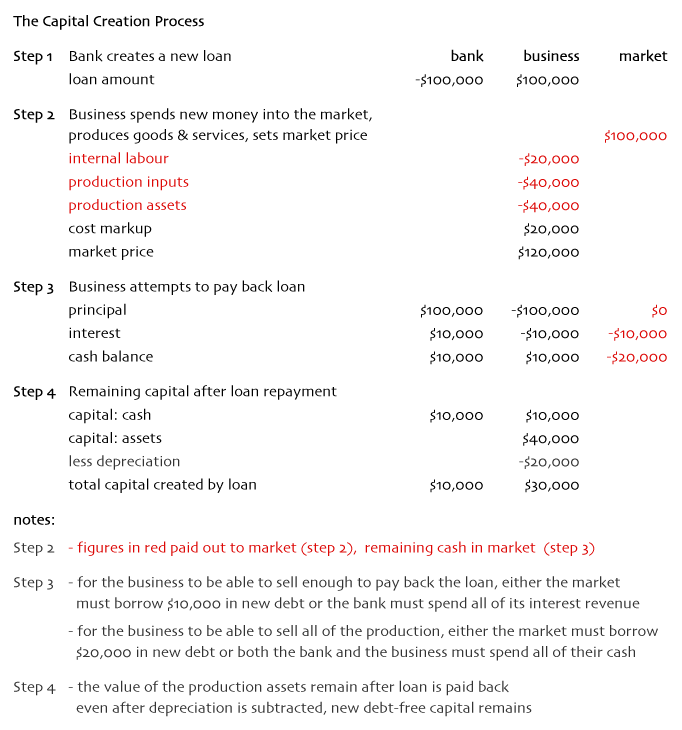

- All debt demands interest. Borrowers must pay back the original amount of the loan (the principal) plus a rental fee (the interest). The longer it takes to pay back the loan (the term) the higher the rental fee. To reduce interest costs, businesses try to repay their loans as quickly as possible, before the assets they finance wear out. When the principal repayment rate exceeds the rate of depreciation, debt-free assets accumulate.

- Businesses must add borrowing costs (both principal and interest) to their prices. Any business that can't make its loan payments will be shut down by the lender. Debt and interest necessitate profit. Profit obscures true costs, distorts prices and is the primary cause of inflation. Profit necessitates the notion of subjective value which provides a convenient camouflage for greed.

- Interest payments send profit to the lender, increasing his financial capital. Principal payments eliminate debt and accumulate assets for the borrower, increasing his physical capital (buildings, machinery & equipment). Businesses also add profit to increase their financial capital. Capital is really just productivity taken from workers and charged to consumers.

Surplus financial capital is then lent out again and the whole process starts over at number 1.

For those who have a mathematical mind, consider the following example which uses three actors: a bank, a business and (the rest of) the market.

About Ownership

- Banks own the money they lend. Others must work first to earn money to lend. Banks just type a few keystrokes and the money they loan becomes theirs instantly.

- Assets purchased with borrowed money belong to the borrower once the loan is repaid in full. People who buy a house to live in themselves must work to earn the money to repay their mortgage. When you pay for something yourself, from your own hard labour, you should rightfully own it.

- Look around you and marvel at the magnitude of the money scam. All of society's commercial assets, the bank towers and shopping malls, the factories and office buildings, the machinery and equipment, all of it... originated as debt, was created by workers, then paid for by consumers, yet none of it belongs to them. It all belongs to business. It was all created as debt, then laundered into private capital at the public's expense.

- Businesses don't pay for the assets they buy themselves. Their customers do. Both loan principal and interest costs are included in the prices they charge their customers. After their customers have repaid the loans, the assets belong to the business. When customers pay for business assets from their own hard labour, shouldn't the assets rightfully belong to them?

Lifting The Veil

It is curious that society's obsession with continuous improvement somehow skipped over our monetary system. Every other product you can imagine has been redesigned, improved and updated hundreds or thousands of times in the last century. Compare the first automobile to the cars of today, or the turn of the century farm to the modern agribusiness. Every field of science, medicine and technology advanced exponentially precisely because it never stopped asking why. Our money system, however, remains basically unchanged. We've added some exotic new accounting formulas and derivatives and expanded our payment and exchange systems, but the basic concept of money is still exactly the same.

So why has so little effort gone into improving our monetary system? Is capitalism already so perfect that it is impossible to improve? Is this really the best we can do? Perhaps more importantly we should be asking who is discouraging improvements in the design of our money system... and why? And why are the people who do suggest a more equal or fair money system immediately labelled as communists or socialists and dismissed as troublemakers.

The answers seem obvious. The true nature of money remains shrouded in mystery because those who control and benefit from it want it that way. So long as the public remains in the dark and fearful of change, the money lenders can work their magic and stay fabulously rich. Their debt-money system can continue to steal the productivity of workers and convert it into private capital for themselves.

Wake up and start talking about this. We can do better. It is time to lift the veil and improve our money system.